The Rise of Options & Derivatives: Trading in Unvertain Times

Trump 2.0 policies promised an era of deregulation and market-friendly narratives, but risk assets have faltered under the weight of tariff tensions and the general economic slowdown. Crypto assets have not been immune, holding a high correlation to equities as adoption becomes more mainstream.

Thankfully, we now have new tools to help us navigate these markets, giving investors more options to generate income across different market conditions.

Joining the Big Leagues

While it hasn't always been a smooth ride, crypto has come a long way from its inception to becoming a major investable asset class for the masses. The launch of the BTC ETFs marked our official arrival with the TradFi audience, and the Trump administration's crypto-friendly policies are signaling that digital assets are here to stay.

Crypto's rising prominence has coincided with a rising correlation to macroeconomic factors and risk sentiment, with BTC consistently exhibiting the highest correlation to the S&P 500 over the past few years. While the theses that Bitcoin serves as a long-term store of value and inflation hedge remain, near-term prices are largely affected by the ebb-and-flow of ETF inflows that are predominantly sentiment driven.

A key driver of this growing correlation is mainstream adoption by institutions, as evidenced by the emergence of pioneers like MicroStrategy, which has evolved from a sleepy, former dot-com era remnant into the largest corporate holder of Bitcoin in the world. The company made history as it raised the largest secondary equity offering on record in late 2024, a $21 billion 'at-the-market' perpetual equity program. All of the proceeds were used to fund Bitcoin purchases, and public investors flocked to the MSTR stock as a way to get leveraged exposure to crypto given the change in regulatory landscape.

Regulated TradFi markets are creating their own crypto options products, mostly based on existing ETF offerings, in anticipation of a surge in mainstream adoption mirroring the same boom we saw with US equities and single-name options on Robinhood. Recent high-profile M&A transactions, such as Kraken's acquisition of a futures trading platform and Coinbase's potential acquisition of Deribit, indicate that crypto is approaching a major growth inflection point.

Rising Options & Derivatives Adoption

Despite a temporary lull in activity across perpetual and futures trading post-FTX collapse, crypto options have bucked the trend and saw a steady rise in activity across all major CEX venues. In fact, options trading volume hit record highs after the Trump election win, with activity stabilizing at a high plateau. All signs are pointing to a continued rise in options volume throughout the year.

Markets move, that's what they are designed to do. Look no further than how crypto prices have fallen despite the positive rhetoric surrounding the strategic reserve, as the entire risk complex was dragged down by worries of an impending economic slowdown and tariff uncertainties. Investor sentiment is often fickle, driving price movements more than the news itself, and underscoring the need for traders to learn to navigate the resulting volatility.

However, contrary to what the casual observer might expect, option implied volatility, aka the cost of 'insurance' hedging in crypto, has been getting steadily cheaper over the years. While many might still think of crypto as an emerging and wild asset class with outsized volatility, the reality is that the ecosystem has matured significantly over the years, and more institutionalized market participants almost always lead to lower volatility. Case in point, one needs to only look at the constant compression of the US equity VIX over the long cycle.

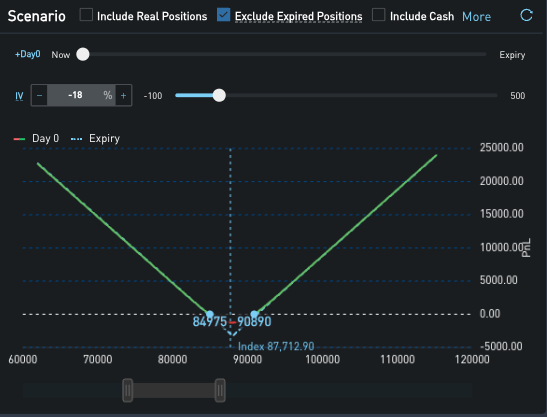

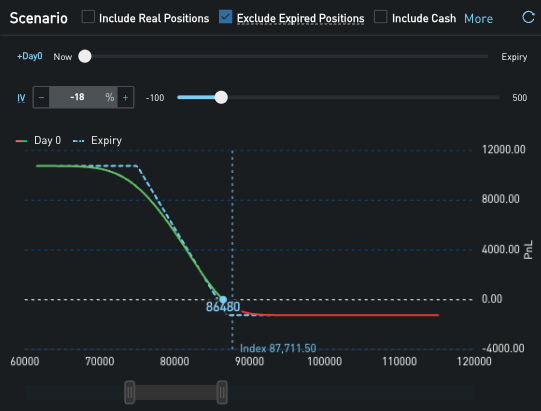

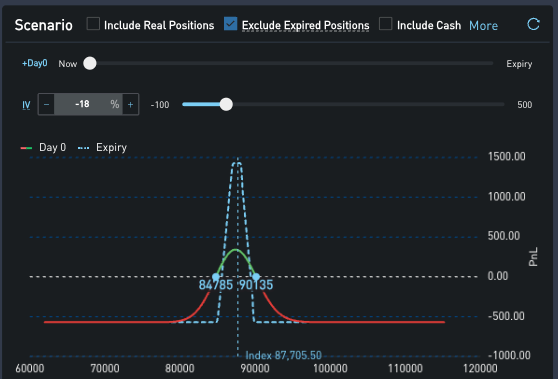

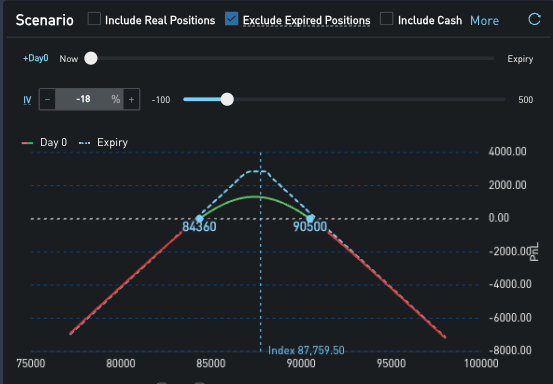

Options can be thought of as Lego building blocks that allow their creators to design various payoff structures. Gone are the days when investors were forced to speculate purely on a one-dimensional bet on whether the market was going up or down. With a clever use of options, traders can bet on a falling market by purchasing puts, define specific profit-taking points by selling OTM calls, or by using call/put spreads to limit their directional loss exposures. Furthermore, classic straddles or strangles can be structured on BTC and ETH to bet on a boring range-bound market or to speculate on a range breakout.

Defining your own payoff scenarios with options. Source: SignalPlus

The 'Hunt-for-Yield' Era

Needless to say, not everyone is a trader. As investor sophistication has grown, so has the demand for new products and payoffs. As markets mature, crypto has been evolving from a purely speculative, FX-like directional market and into a more stable, yield-based environment where investors are seeking stable income sources to supplement their riskier exposures. Specifically, large wallet holders and long-term investors who have amassed significant crypto capital have been searching for steady, income-based products in crypto as well, similar to the 'hunt-for-yield' theme that has dominated traditional capital markets for well over a decade.

Similar to TradFi markets, options provide one of the steadiest sources for yield income by monetizing implied volatility. If we think of purchasing options as similar to buying an insurance plan, a healthy market will always see both buyers and sellers of options, with the former generally looking for protection (exposure), and the latter looking to earn income (premium).

In fact, the exchange players have been actively offering savings-like products, or even more esoteric 'structured products' to give depositors a downside-protected way to earn income. Many of these products carry an embedded-option component wrapped under the note, with demand for these products expected to rise many-fold as more institutional accounts arrive.

Recent Market Developments

The Trump administration's new trade policies have led to unprecedented volatility and turmoil in financial markets, to say the least. Macro assets have seen record-setting moves, and even professionally managed portfolios have suffered from significant PNL drawdowns. Zero-day options on the S&P 500 recently hit record volumes, with average volumes exceeding $1.5 trillion on a daily basis, constituting nearly 60% of all options traded against the index.

Correlations are being broken as markets reconsider the role of USD assets as a safe haven holding, and BTC is regaining its narrative as an alternative store of value in the new world order. Regardless of how the trade war ultimately shakes out, capital account surpluses are intricately linked to current account deficits, and any attempts to reset the latter will ultimately result in less capital flowing into US markets, with crypto being high on the list of alternative assets to be considered. Furthermore, with manufacturing reshoring and trade barriers leading to costlier consumer goods, any monetary easing from the Fed will be conducted against a backdrop of higher prices, providing a further tailwind to BTC as an inflation edge.

Finally, all of this is happening with an administration that is 'all-in' on crypto with their legislative-friendly policies, additional crypto ETFs being approved, perp futures expected to be listed on US exchanges, various option derivative products being launched, and the Trump family planning to issue their own stablecoin. The long-term bull-case for crypto is as strong as it's ever been, with all stars being aligned for crypto to play a permanent role as an investable asset class in the average mainstream portfolio.

Institutional Adoption is Here

As with everything else in life, we should focus our efforts on outcomes we can control, and let the greater powers handle the ones that we can't. Will the Trump administration allow the US to enter a recession to advance his agenda? Or will his tariff threats be more bark than bite, thus putting risk assets back on the positive path? Do the recent rallies in China and European assets have legs and offer a positive spillover to crypto? And will the Fed ultimately end up cutting rates more than 1-2x this year, offering a more dovish bias than market expectations to the benefit of hard assets and crypto?

All of these are dynamic and fun speculation points, and the market will never sit still. As Benjamin Graham stated, markets are a voting machine in the short run versus a weighing machine in the long run. We would encourage investors to focus on the long-term prospects of crypto and use the various options instruments and tools available to them to risk-manage their holdings for the long term.

Despite market uncertainties, we now have the foundation and effective tools in place to usher in a new era of crypto institutiobnalization, driven by increasing capital inflows and investor sophistication. For the speculators among us, options offer asymmetric upside against protected downside rewards for those convicted trades and is a viable tool to have in any trading repertoire.

Augustine Fan is an experienced professional with over two decades of distinctive track records across Wall Street, family offices, private equity, and now crypto. Along with his current leadership efforts at SOFA.org, he also serves as Partner & CFO of SignalPlus, a leading digital asset software technology for crypto optionscPrior to joining crypto, Augustine worked for a decade at Goldman Sachs as a US interest rates trader and macro specialist in NY, London, Tokyo, and HK offices. Following his time on Wall Street, he joined a significant shipping-based family office in HK to help manage one of the most active secondary macro trading portfolios in Asia. He further refined his investment acumen as the CIO for another HK-based family office, with a deeper focus on private equity, credit, real estate, listed vehicles, and frontier investments.

Digital Assets Stall Below Weekly Highs - Why Retail Profit-Taking Could Create a Dip

Your daily access to the backroom...

CZ Denounces Bloomberg Report as "Fictional Attack" Amidst Malaysia Crypto Hub Discussions

While Bloomberg focused on his post-prison pivot to regulatory advising and his past legal issues, Z...

Securitize, Mantle Introduce Institutional Crypto Fund With Yield-Enhancing Strategies

The fund It will be anchored by a $400 million investment from Mantle Treasury, following the approv...